Following Boparan Restaurant Group’s partnership with Sainsbury’s in 2022, Greggs has announced that it is opening its cafés in up to half a dozen Sainsbury’s by the end of 2023, and dessert restaurant brand Creams Café has announced a franchise agreement with Tesco.

It is no secret that the food service industry in the UK has faced some of the harshest conditions since the pandemic, with soaring energy costs and dwindling sales. The continuing trend for partnerships with retailers appears to be a safer bet for foodservice brands. These agreements afford foodservice operators a high-profile store presence while also allowing overhead costs to be shared with a retail partner.

Branded locations breathe life into supermarket cafés

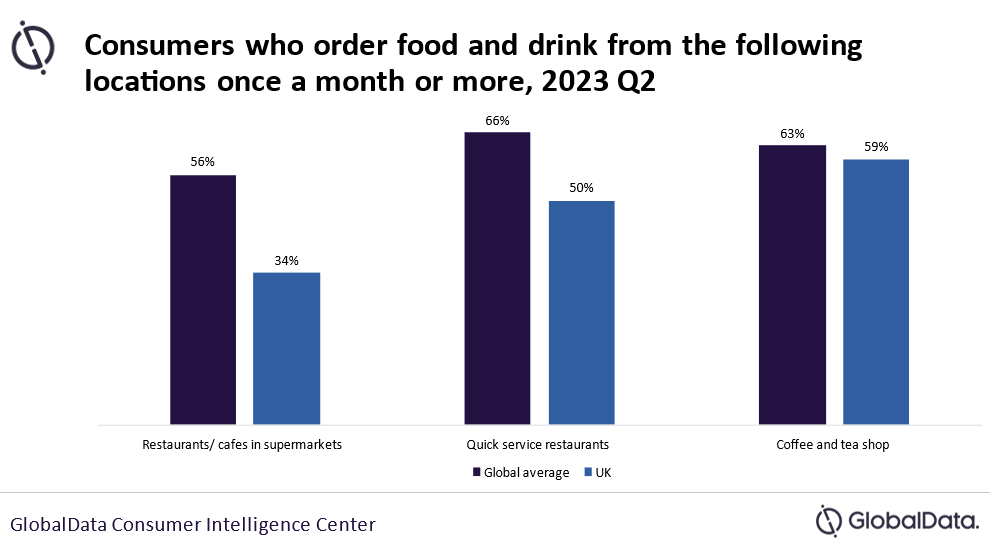

These partnerships can also prove beneficial for supermarket and retail sales. GlobalData’s survey reveals that the number of consumers in the UK ordering from restaurants or cafés in supermarkets at least once a month or more was 22% lower than the global average. Meanwhile the number of people doing so for quick service restaurants and coffee and tea shops was much higher for the UK and globally overall, suggesting supermarket restaurants and cafés lack the appeal of other food service channels. Foodservice branded in-store locations can breathe life into lacklustre supermarket café or restaurant spaces, as consumers are already familiar with their menus.

These partnerships can also tap into altered shopping behaviours during the cost-of-living crisis. One in five consumers globally report shopping more frequently but purchasing less each time to cope with rising prices. The attraction of a branded café or restaurant on site can encourage these frequent shoppers to spend more time in store before or after a pause for refreshment. A multi-brand space is attractive to time-poor consumers as everything they need is in one location.

Foodservice brands have had to be much more adaptable in their service and offerings since the pandemic, and consumer behaviour patterns have been erratic, impacted by high inflation and other lifestyle factors such as hybrid working. Almost a year on from the Boparan and Sainsbury’s partnership launch, it is clear there have been significant mutual benefits as they have announced 30 more openings for 2023 across the UK.

Boparan’s portfolio of restaurants consists mainly of mid-range full-service restaurants, which is appropriate for the regular customers of a mid-range supermarket such as Sainsbury’s. Only time will tell if the Creams and Greggs partnerships work just as well, but it is important that companies ensure brand identities and customer bases are suitably aligned when entering these agreements