The consumer industry continues to be a hotbed of patent innovation. Activity is driven by guided health, personalized nutrition, and technology and growing importance of technologies such as machine learning, artificial intelligence (AI), and cloud. In the last three years alone, there have been over 52,000 patents filed and granted in the consumer industry, according to GlobalData’s report on Innovation in consumer: nutrition recommenders. Buy the report here.

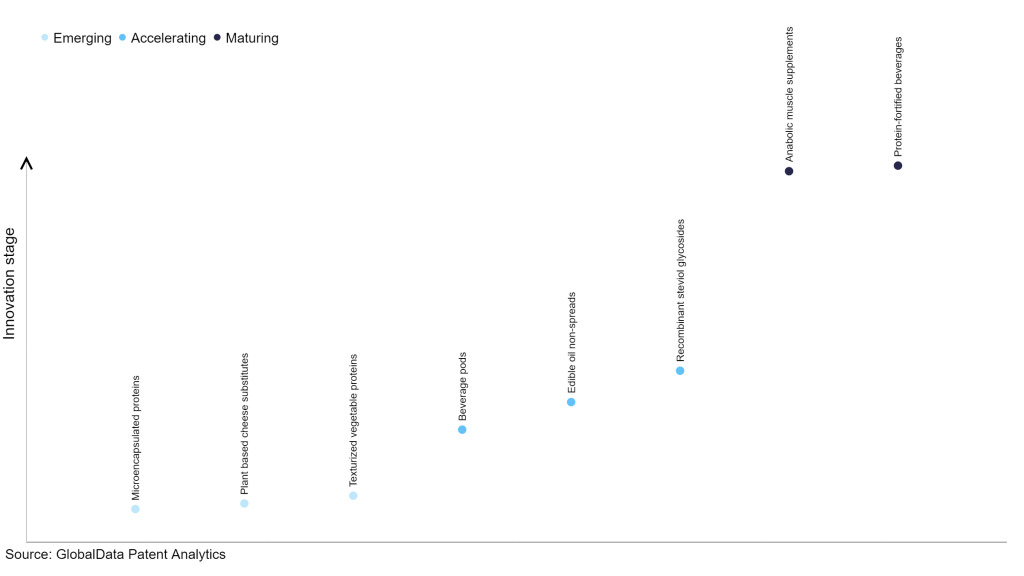

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

30+ innovations will shape the consumer industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the consumer industry using innovation intensity models built on over 12,000 patents, there are 30+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, microencapsulated proteins, plant-based cheese substitutes, and texturized vegetable proteins are disruptive technologies that are in the early stages of application and should be tracked closely. Beverage pods, edible oil non-spreads and recombinant steviol glycosides are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are anabolic muscle supplements and protein-fortified beverages, which are now well established in the industry.

Innovation S-curve for the consumer industry

Nutrition recommenders is a key innovation area in consumer

Nutrition recommenders are content-based systems that help healthy eating habits. These systems use the information about the ingredients and nutritional content of different foods to offer personalized food recommendations to users. These systems take many factors into consideration such as a person’s dietary restrictions and preferences, along with allergies. With the rise of machine learning and artificial intelligence, these systems have become more robust and can analyze the data and feedback from consumers in a short time to give better recommendations.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 80+ companies, spanning technology vendors, established consumer companies, and up-and-coming start-ups engaged in the development and application of nutrition recommenders.

Key players in nutrition recommenders – a disruptive innovation in the consumer industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to nutrition recommenders

Source: GlobalData Patent Analytics

In terms of patents filed, Adidas is the leading company in the nutrition recommenders space, while Technikka Conexion and Samsung Group are in the second and third positions, respectively. In March 2023, Zoe Global, another leading patent filer in this space, received $2.5m in funding from Steven Bartlett’s Flight Fund. The company aims to use the funding to invest in its personalized nutrition platform.

In terms of application diversity, Maplebear is the leading company, while Personal Remedies and FoodPairing are in the second and third positions, respectively.

By means of geographic reach, Aegle Health leads the pack, followed by Genesant Technologies and International Business Machines (IBM).

Personalized health will gain traction in the coming years, with the growing health awareness among consumers. Young consumers will seek guided nutrition plans, backed by data. AI-based nutrition recommenders will gain momentum for their accuracy.

To further understand the key themes and technologies disrupting the consumer industry, access GlobalData’s latest thematic research report on Consumer.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.