Aldi UK has announced a one-day-only hot pizza delivery service in select UK cities, targeting students and promoting its new pizza range in early October 2023. The service closely mimics Domino’s menu items. This fleeting foray into takeaway is clearly a marketing stunt to encourage retail sales more than a genuine attempt to compete with other takeaway restaurant players.

However, it reflects the fact that more and more consumers are engaging with the fake-away trend during the cost-of-living crisis. So-called fake-away products are packed food and beverages sold in retail spaces such as supermarkets, which emulate well-known restaurant take-away menu items. It has been noted without much fanfare that UK supermarket Asda has provided a hot pizza delivery service fulfilled by Just Eat since 2018, yet only recently has the fake-away trend increased in popularity, since the marked improvement in consumer perception of private-label quality post-pandemic.

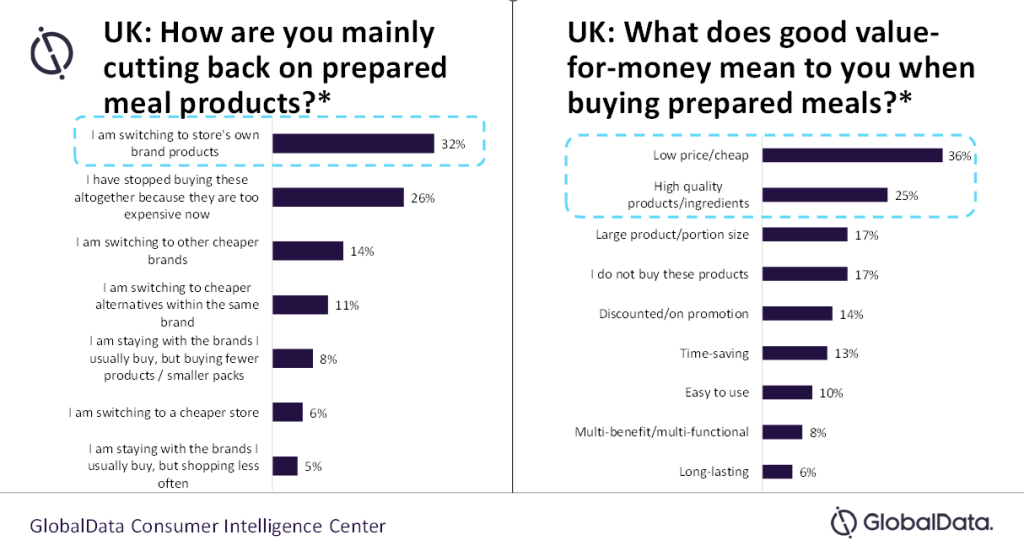

Consumers have partially turned their backs on multinational consumer goods brands, seeing that private-label products will deliver similar results. When it comes to prepared meals, the most popular way for consumers in the UK to cut back in 2023 is to buy a store’s own brand products (private-label)*.

UK consumers also prioritised affordability and quality above other value-for-money factors in prepared meals, so private-label’s positioning has been able to effectively balance these demands. With 54% of UK consumers reporting ordering takeaway/delivery less frequently or stopping altogether, prepared meals marketed to imitate takeaway menu items have been able to fill the gap for consumers craving an affordable treat.*

It is important, however, for supermarkets launching fake-away-style meals to ensure that the level of quality and indulgence is of a similar standard to that expected in takeaways. As the second most popular way to cut back, more than one in four Brits have stopped buying prepared meals altogether because they are too expensive, suggesting that for some consumers this category is not worth the additional costs compared to buying products to cook from scratch and possibly continue to order takeaways alongside on a less frequent basis. At a time when consumers are especially price-sensitive, they need to see a clear justification of value in treat and indulgence categories with a higher price tag.

Aldi’s Ultimate Takeaway range has been specifically marketed as an affordable replacement to Domino’s, so if the formulation is effective, it has a clear opportunity for consumers to make value comparisons with the pizza delivery chain. Domino’s itself announced in its August 2023 interim results that it no longer expected price hikes after facing a tough macro-environment in the UK post-pandemic, with steady sales beating analyst expectations. With this in mind, it is unlikely that the fake-away market could ever steal a majority share of sales from takeaway delivery players in food service. However, after having announced partnerships with Just Eat and UberEats to fulfill deliveries that Domino’s could no longer manage itself, it is clear that takeaway continues to face challenges.