2023 has become an increasingly pessimistic year for the plant-based food market, with many high-profile brands facing headwinds. France’s fresh proposals to restrict marketing language used by plant-based brands such as “steak” and “ham” add an additional threat to the market’s future.

Growth forecasts for plant-based food and beverage categories have dampened in 2023, and plant-based companies will need to retain their innovative streak to stay afloat. The category is under scrutiny both for health and sustainability credentials, so brands will have to go back to the drawing board in terms of production, formulation, and now possibly marketing.

In recent history, Europe as a region has shown resistance to animal alternatives from political and meat and dairy industry groups, despite the popularity of these products among European consumers. The European Union restricted plant-based dairy alternatives from describing their products as “milk,” “butter,” “cheese” and “yogurt” in 2017, and in 2023, Italy took steps to ban the sale of cultured meat. Whether these legislations are short-sighted in the face of sustainability and resource issues or necessary protection of culturally significant industries, the question remains whether they will impact animal alternative product performance and how brands can take action.

Oatly, the Swedish oat-based food and beverage brand, resonated with consumers who valued its bold marketing and brand identity as it took aim at the EU’s legislation restricting marketing for plant-based products. Recently, however, it has revised its growth forecasts in a tough macroeconomic environment and continues to be embroiled in controversy as regulatory authorities clamp down on its sustainability claims, making its provoking PR stunts seem hollow. 57% of consumers globally agree they would stop buying from a brand that doesn’t align with their personal beliefs and values and another 57% agree they notice when brands change their packaging to promote a set of values.

Brands must learn from Oatly’s misfires to tread carefully when updating their marketing on packs and elsewhere due to regulatory change. Ethical consumption – a “better for you, better for the planet” ethos – can be seen as the overarching motivation for buying plant-based and meat-free alternatives, so it is important that brand marketing employs honest and sensitive messaging.

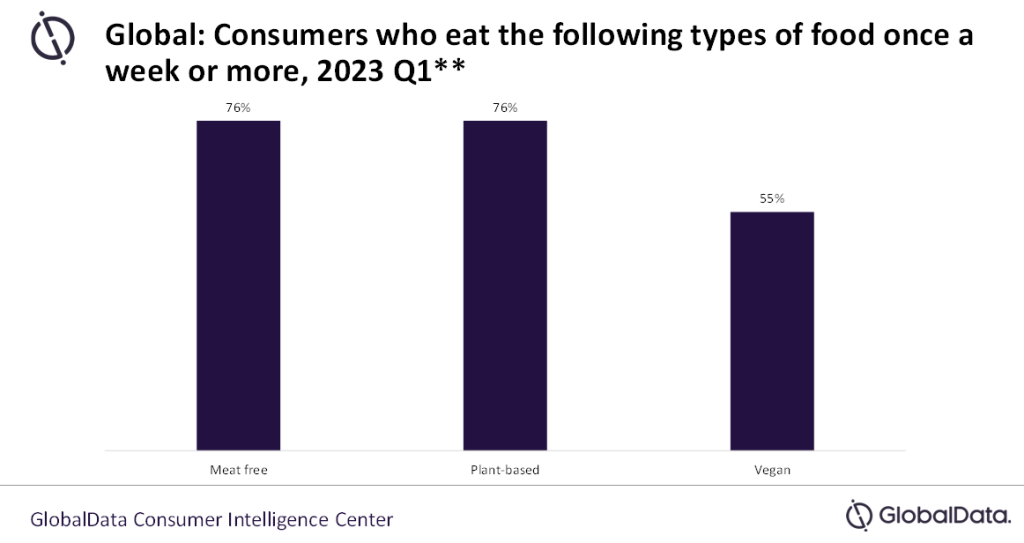

However, the animal alternative outlook is not all doom and gloom, as high numbers of consumers continue to report regularly consuming these types of products in 2023, despite health, sustainability and cost concerns. Many consumers have yet to commit to vegan or even vegetarian diets exclusively, but see the benefits of incorporating animal alternatives into their diets. Since their inception, animal alternative food and beverage companies have been praised for being industry pioneers, and consumers will continue to expect brand innovation as the market navigates new challenges post-pandemic.