Roark Capital, the owner of Inspire Brands – whose subsidiaries include chains such as Dunkin’ Donuts, Baskin-Robbins, Arby’s and sandwich QSR [quick service restaurant] Jimmy John’s – should be well-qualified to acquire Subway. The sandwich giant has more outlets than McDonald’s (33,000 plus) and had a market value of $17.2 billion in 2022. However, while this asset (which has a price tag of $9.6 billion) gives Roark a significant slice of the food service industry, it comes with challenges. Subway announced its tenth consecutive quarter of positive sales in July 2023, but its historic performance has been very uneven.

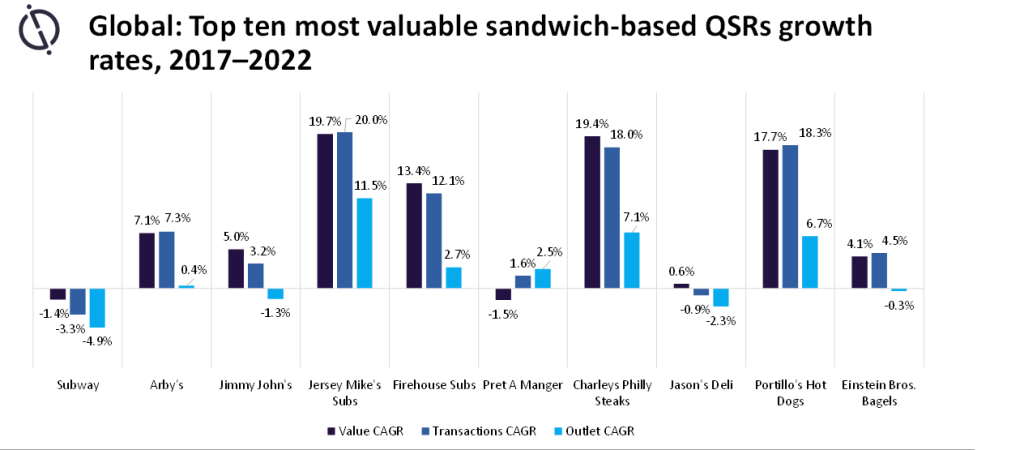

Alongside the industry-wide pressures of the pandemic, the rush for online delivery, inflation, and ingredient and labour shortages, Subway has also had to reckon with an increasingly competitive and saturated sandwich-based QSR market, particularly in the US. The chart below shows how Subway has had the worst market performance since 2017 when compared to the other top sandwich chains globally. Subway recorded the greatest negative growth rates when measured across value, transactions and outlets. Subway is one of the oldest chains on this list, making it a household name, but in recent years it has failed to stand out from newcomer sandwich chains, which have offered more exciting and higher-quality menus.

GlobalData’s recent Success case study on Jersey Mike’s points out that “Subway’s market value has fluctuated over the years, with a decrease in 2020 and an increase in 2021, reaching $10,697 million, still catching up to its 2017 value. Subway struggled with adapting to the shift to take-out and delivery, as the chain relied heavily on dine-in customers, especially during the pandemic, which led to the closure of hundreds of stores across the US and other countries. Subway will have a tough time adapting its menu and prices to meet new customer needs and market conditions as customers shift to take-out and delivery. It also needs help to make sure that its prices are competitive with other fast-food chains.”

While some chains can successfully avoid offering delivery services post-pandemic, Subway’s weakening value proposition is something that can’t be ignored. Subway has long been known for its $5-footlong deal but has ultimately proved unsustainable under inflation. Meanwhile, the chain’s low-quality, unhealthy image, fuelled by scandals such as the tuna lawsuit and the conviction of former spokesperson Jared Fogle for sexual offences left Subway with few options outside of low pricing.

Fellow sandwich QSR Quiznos fell into similar issues with a meteoric rise and fall in the market, failing to find a competitive standpoint with high prices and lacklustre offerings. Over the past two years, Subway claims to be carrying out a new strategy to revitalise the business, which will continue after the acquisition by Roark. The strategy involves new menu developments, more modern and digitalised outlets and international expansion, which appears to be on the right track. However, such a large network of outlets is incredibly difficult to manage and improve, given the tough macroeconomic environment. It has deliberately trimmed down some of its outlet count in the US, but its insistence on more international expansion means Subway is a definite “watch this space” – to see if it can pull through.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData